29+ Refinance rates 15 year fixed

The average rate on the popular 30-year fixed mortgage fell to 522 on Thursday from 554 on Wednesday according to Mortgage News Daily. How to compare 30-year fixed mortgage rates.

Matt Lateer Associate Broker For Long And Foster

Looking for a combination of a lower interest rate and a smaller monthly mortgage payment may do well to consider 15-year terms.

. Homeowners looking to refinance may find that 15-year terms offer the best opportunity. Rate Pts Rate Pts Rate Pts Rate Pts. View 30-year and 15-year fixed rates and ARMs in your area.

The average interest rates for both 15-year fixed and 30-year fixed mortgages both drifted higher. On Sunday September 11 2022 the national average 30-year fixed jumbo refinance APR is 6100. 30-Year Fixed-Rate Mortgages Since 1971.

1-Year CD Rates Over 2 Are Tempting But Preserving Liquidity In A Crisis Is Essential. 30-Year Fixed-Rate Mortgages Since 1971. With a fixed-rate loan the interest rate remains the same for the entire span of the mortgage.

The average rate for 2021 was 296 the. Compare free APRs from top lenders to find the best fixed or adjustable rate mortgage for you. The national average annual percentage rate APR on a 30-year fixed mortgage refinance on December 3 2021 is 331 while the 15-year fixed mortgage refinance is 266.

The origination fee may be waived for a 025 increase in the interest rate. 5-Year Adjustable-Rate Historic Tables HTML Excel. The average 51 adjustable-rate mortgage ARM rate is 4520 with an APR of 6300.

A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. Ivy Bank Raises Online Savings Rate to 215 APY - Aug 3 2022. At the same time average rates for 51 adjustable-rate mortgages also went up.

For primary residences and second homes only. 4500 down from 5000. Across the United States 88 of home buyers finance their purchases with a mortgage.

FOX 29 Originals. Changes in Average Loan Rates for 15-Year Fixed Mortgages. Commonly people select 3 or 10-year fixed-rate mortgages.

The average 30-year fixed jumbo mortgage APR is 6080 according to Bankrates latest survey of. Rates for this term hit their lowest point of 2022 so far during the week. Rates for this mid-length term are more than half a point lower than rates for longer terms and offer homeowners the opportunity to be mortgage.

15-year fixed-rate refinance. Rates displayed are the as low as rates for purchase loans and refinances. A 30-year fixed-rate home loan is a mortgage that will be completely paid off in 30 years if all the payments are made as scheduled.

Rates on 10-year fixed-rate refinance loans averaged 546. Use the estimated price for the home youre buying or use our home value estimator to see how much your home is worth for a refinance. However you can get a term length ranging from 1 to 10 years.

Rates quoted above require a 100 loan origination fee. Over the past 20 years housing rates have slowly decreased. Bask Bank Raises Online Savings to 202.

2007 2006 2005 2004 2003. Current Mortgage and Refinance Rates. The average 15-year fixed mortgage rate is 5310 with an APR of 5350.

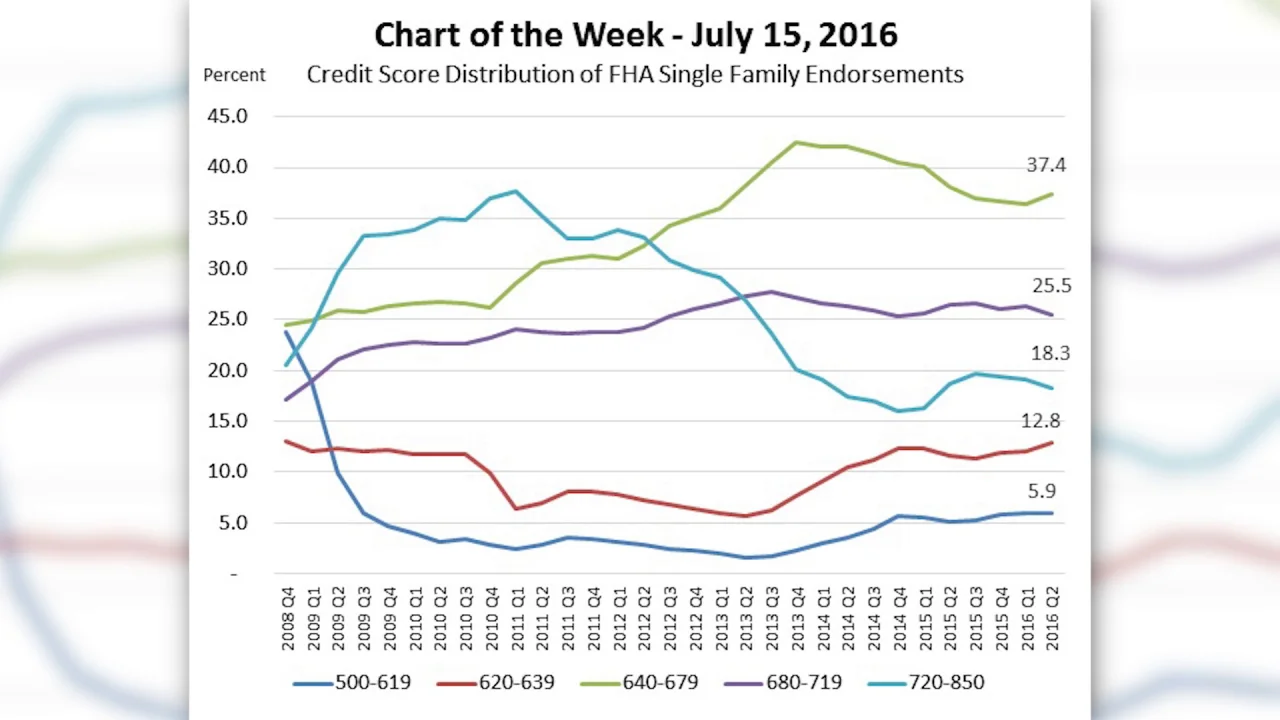

Bringing 15- and 10-year rates back under the 5 mark. 15-Year Fixed-Rate Historic Tables HTML Excel. Rates are based on an evaluation of credit history so your rate may differ.

The average APR on a 15-year fixed-rate mortgage rose 3 basis points to 5227 and the average APR for a 5-year adjustable-rate mortgage ARM fell 5 basis points to 5241 according to rates. A fixed rate IRA CD offers tax-free or tax-deferred interest. For borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender during the week of Aug.

The 3-year fixed-rate mortgage is a shorter commitment while the 10-year fixed-rate mortgage offers more stability but. The graph below shows annual average housing rates for 15-year fixed mortgages from July 2000 to July 2020. The average APR on a 15-year fixed-rate mortgage rose 3 basis points to 5227 and the average APR for a 5-year adjustable-rate mortgage ARM fell 5 basis points to 5241 according to rates.

Mortgage refinance rates fell today bringing 15- and 10-year rates back under the 5 mark. When talking about a 30-year fixed-rate mortgage it typically refers to conventional loans. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

However interest rates for a 30-year refinance will typically be higher than rates for a 15-year or 10-year refinance. What this means. Annual Average 366 07 445 07 469 07 504 07 603 06.

Compare purchase or refinance rates. Homeowners looking to. 5000 down from 5125 -0125.

If you compare loan offers from mortgage lenders youll have a better chance of securing a competitive rate. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. Itll also take you longer to pay off your loan.

Compare the best fixed rate IRA CD rates from within 20 miles from your zip code. Rates on 10-year fixed-rate refinance loans averaged 544 down from 546 the week before and up from 351 a year ago.

Greensky Inc 2018 8 K Current Report

Virtjoule

Five Ways The U S Elections Might Affect The Auto Industry

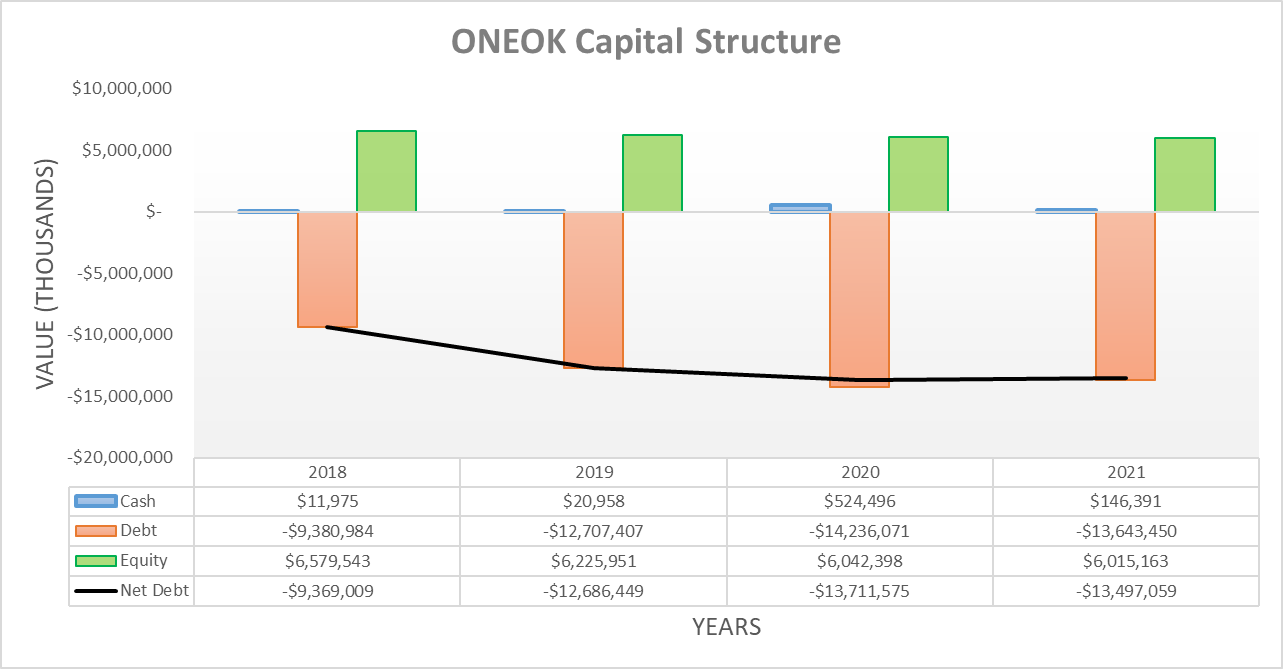

Oneok Strong Performance A New Era For Dividends Nyse Oke Seeking Alpha

Matt Lateer Associate Broker For Long And Foster

Oneok Strong Performance A New Era For Dividends Nyse Oke Seeking Alpha

Virtjoule

Investor Presentation

Greensky Inc 2018 8 K Current Report

41 Of All Realtors Are Over 60 Years Old

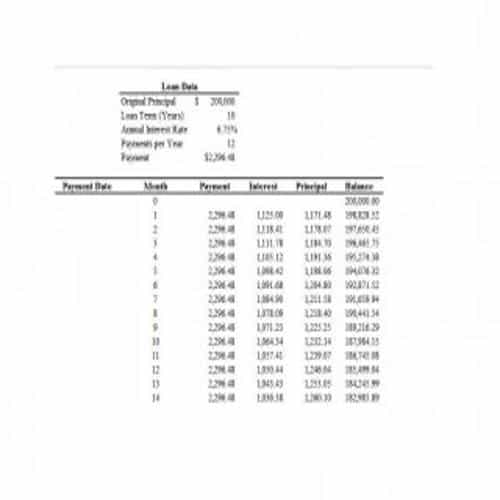

29 Editable Loan Amortization Schedule Templates Besty Templates

The Best Investment Right Now Might Actually Be Used Cars Or Trucks

2

29 Promissory Note Samples Google Docs Ms Word Apple Pages Free Premium Templates

29 Promissory Note Samples Google Docs Ms Word Apple Pages Free Premium Templates

2

29 Editable Loan Amortization Schedule Templates Besty Templates